Unisciti alla Sfida di PU Xtrader Oggi

Fai trading con capitale simulato e guadagna profitti reali dopo aver superato la nostra valutazione del trader.

Unisciti alla Sfida di PU Xtrader Oggi

Fai trading con capitale simulato e guadagna profitti reali dopo aver superato la nostra valutazione del trader.

28 March 2023,05:51

Daily Market Analysis

The banking crisis was seemingly resolved after yesterday’s news reported that First Citizens Bancshares Inc agreed to buy Silicon Valley Bank. On top of that, the U.S. authorities are considering expanding its emergency lending facilities for banks to shore up the bank’s balance sheet, which in a way supports the embattled First Republic Bank. Gold prices plunged by 1% last night and stimulated oil prices to trade above $70 per barrel as the market further weighed down the banking crisis risk. On the other hand, Australia recorded a contraction in month-to-month retail sales as evidence that household spending is beginning to slow down; this increases the chance that the RBA is going to introduce a smaller rate hike or even pause the rate hike in April. Elsewhere, Binance’s CEO is being sued by CFTC after an alleged regulatory violation; the news has little impact on BTC prices, which dropped by 0.3% last night.

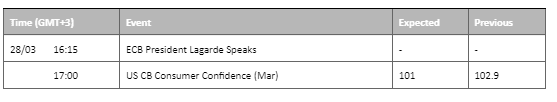

Current rate hike bets on 3rd May Fed interest rate decision:

0 bps (61%) VS 25 bps (39%)

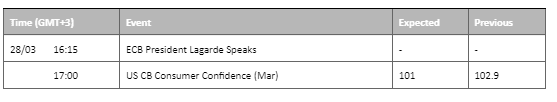

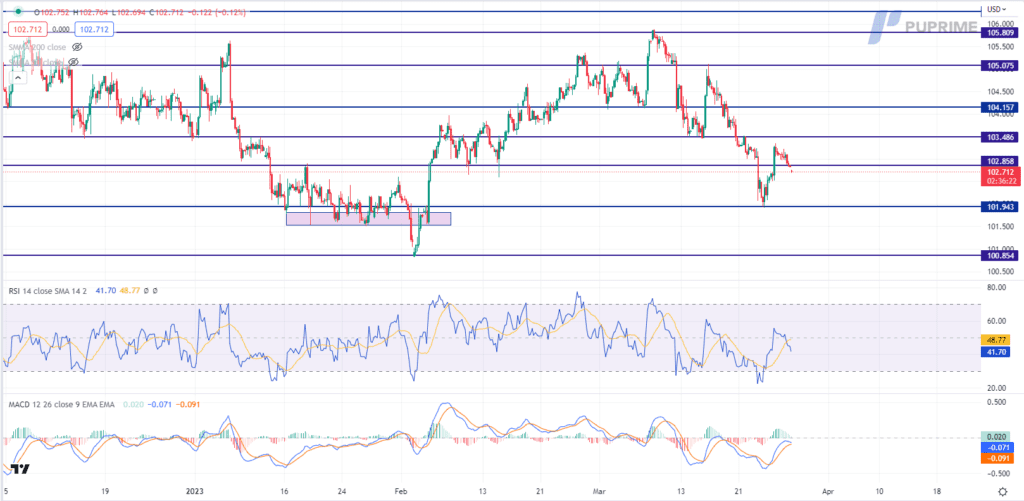

The safe-haven US Dollar experienced renewed sell-off as global risk appetite rebound yesterday, buoyed by news of First Citizens Bancshares’ acquisition of the remaining assets, loans, and deposits of collapsed Silicon Valley Bank for a staggering $72 billion. The move has brought some much-needed relief to investors who have been grappling with a wave of banking turmoil in recent weeks and sparked a surge in First Citizens Bancshares’ share price, which skyrocketed by over 53% on the news. With the banking turmoil now seemingly under control, market participants are turning their attention back to the monetary policy decisions of global central banks.

The Dollar Index is trading lower following the prior breakout below the previous support level. MACD has illustrated diminishing bullish momentum, while RSI is at 42, suggesting the index to extend its losses in short-term.

Resistance level: 102.85, 103.50

Support level: 101.95, 100.85

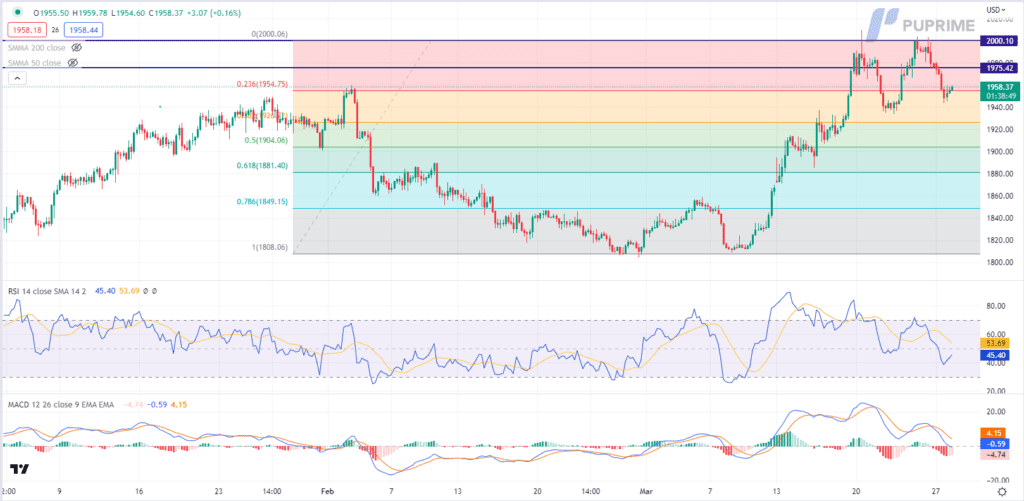

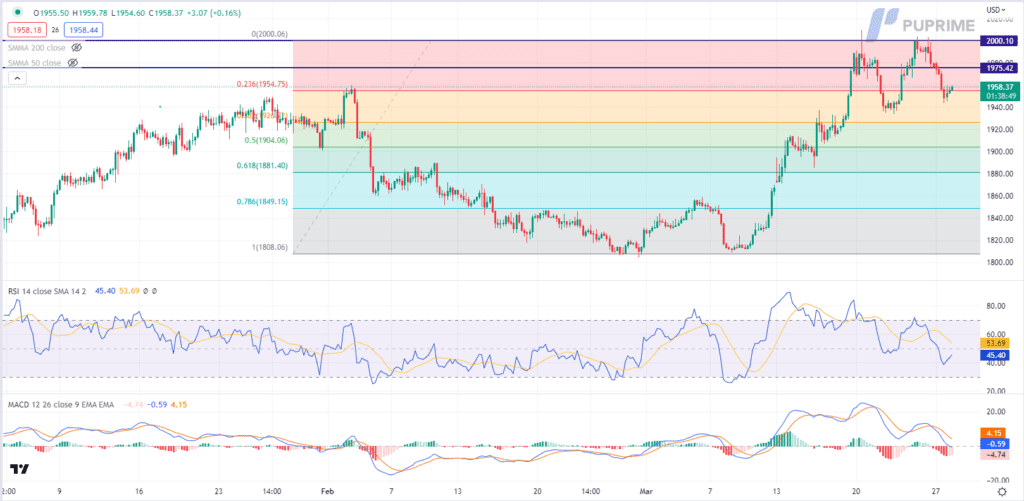

Gold prices retreated as investors turned to riskier assets following the news of First Citizens Bancshares’ acquisition of the remaining assets, loans, and deposits of Silicon Valley Bank for a whopping $72 billion. The move provided much-needed relief to investors amid recent banking turmoil, leading to a surge in First Citizens Bancshares’ share price, which soared by over 53%. The acquisition is expected to strengthen the bank’s position in the market, and investors are optimistic about its growth potential. As a result, safe-haven assets like gold lost their appeal as market sentiment shifted towards risk-on.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggesting the commodity might extend its losses since the RSI stayed below the midline.

Resistance level: 1975.00, 2000.00

Support level: 1955.00, 1925.00

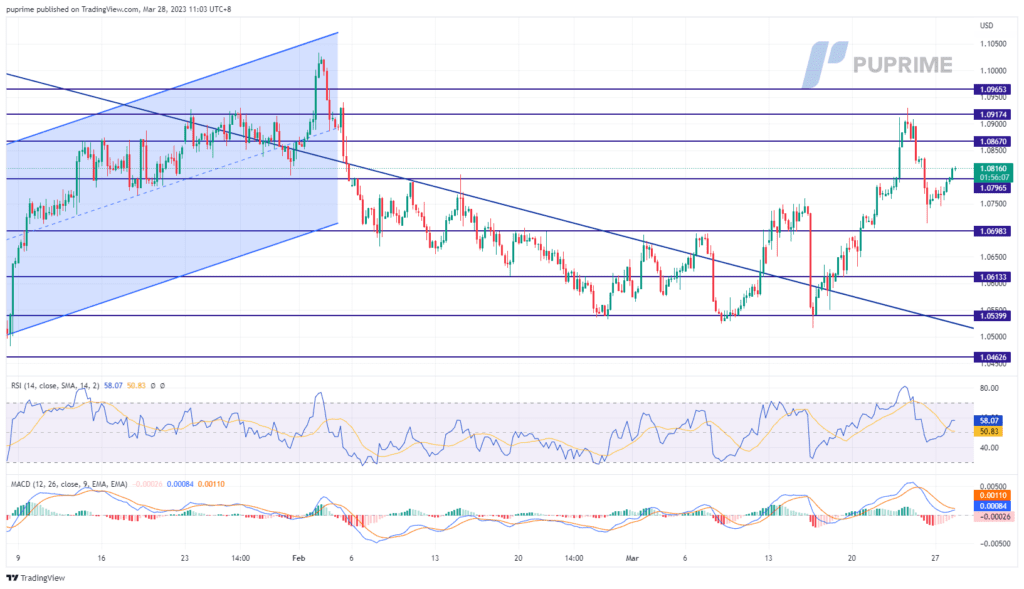

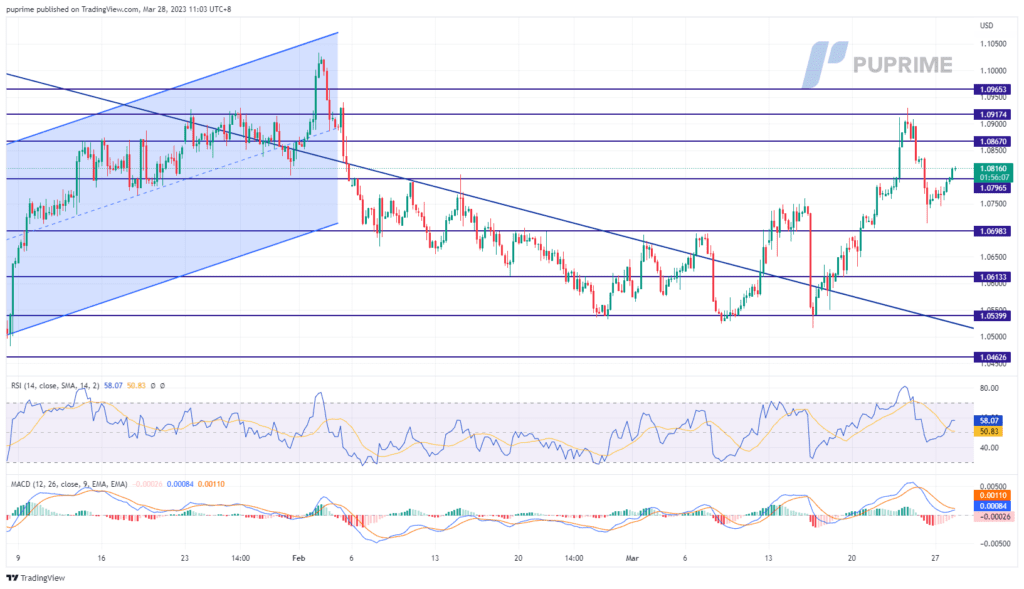

The market welcomes the news of First Citizens Bancshare Inc buying over Silicon Valley Bank as the risk-on sentiment is surging. The positive sentiment in the market led to a drop in the dollar index for 2 consecutive sessions and it is trading below $103 as of writing. On the other hand, the ECB governing member Joachim Nagel said that the ECB is determined to fight inflation and the euro central bank might accelerate the quantitative tightening pace with a steeper rate hike after March. However, given that the banking crisis in the U.S. is over and the Fed is prioritising its focus on taming inflation, the Hawkish tone from both sides of central banks may be offset with each other.

The indicators depict that the bearish momentum has eased for the pair with the RSI moving upward from near the 50-level while the MACD rebounded before the zero line.

Resistance level: 1.0867, 1.0917

Support level: 1.0698, 1.0613

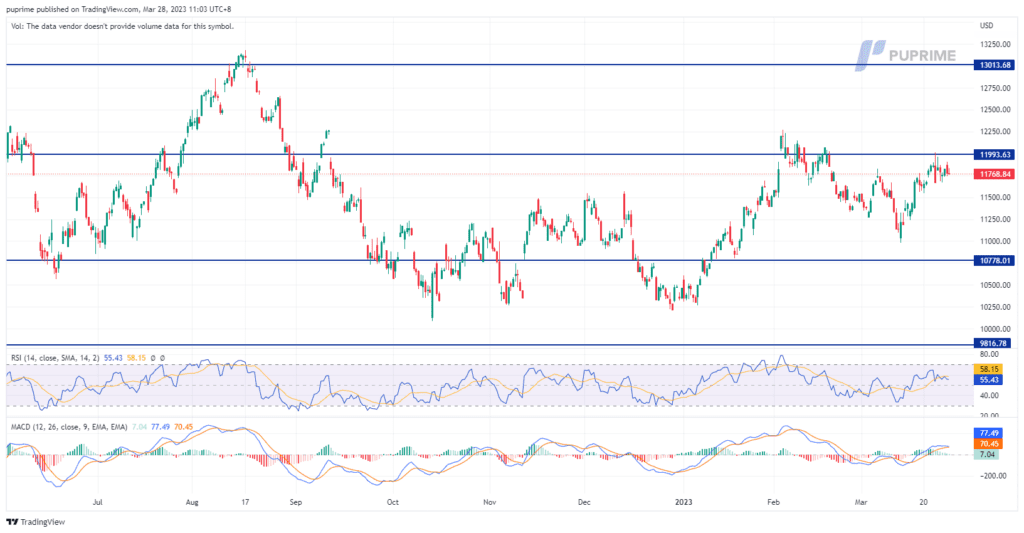

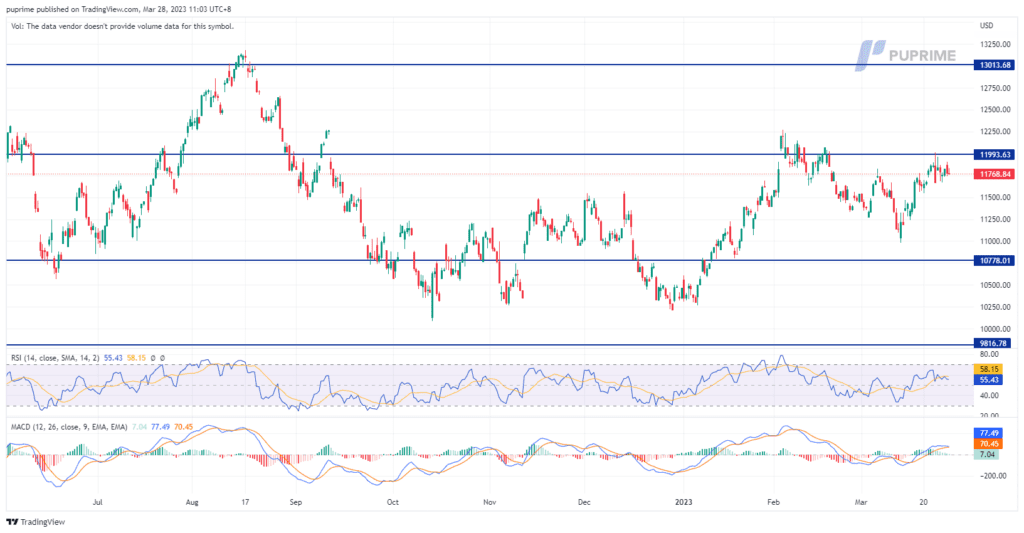

The Nasdaq index fell 0.47% to 11,768 points on Monday, capping a two-week advance. Tech and growth stocks faced some profit-taking as they headed into the end of the quarter. The market is being pushed and pulled between banks and tech stocks. As the banks have rebounded, a lot of money has come out of tech stocks which have helped up the market the past two weeks. Moreover, there is a lot of churning under the surface right now. Adding the backup in interest rates pours cold water into the tech trade. For now, investors will closely watch data on the PCE price index that will come out later this week for direction on the US central bank’s rate path.

The movement of the index remains neutral-bullish. MACD has illustrated a slightly bullish momentum ahead. RSI is at 55, indicating a neutral-bullish momentum in the near term.

Resistance level: 11993, 13013

Support level: 10778, 9816

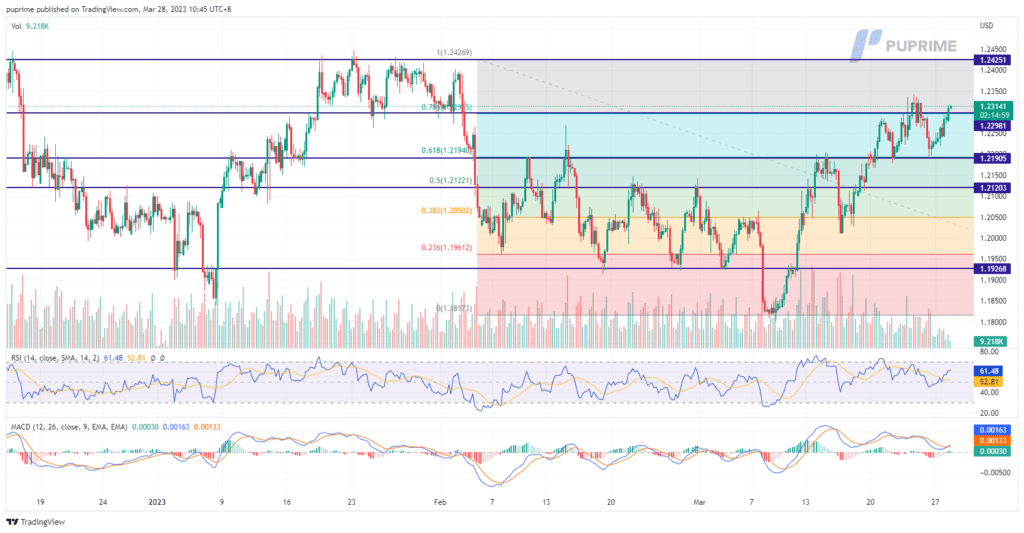

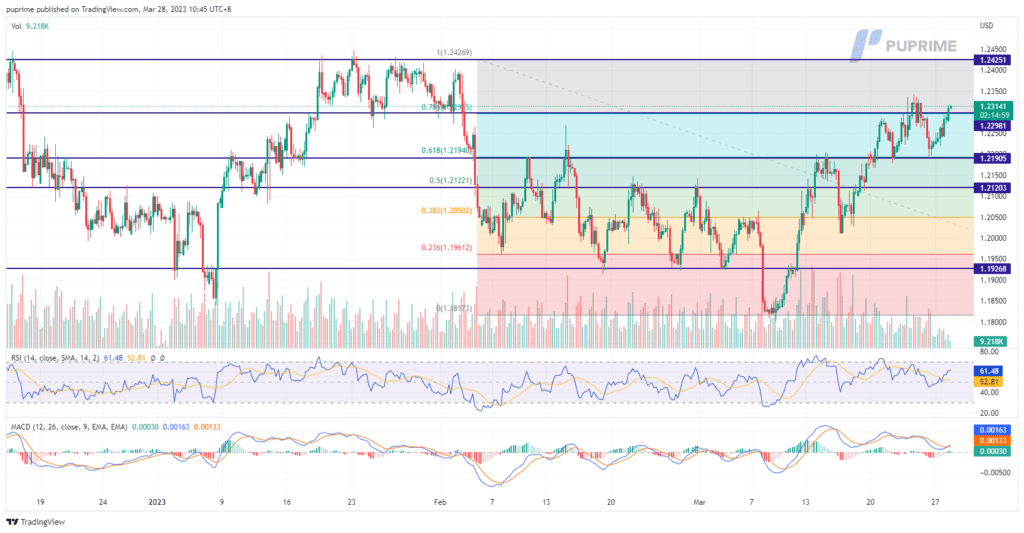

The Pound Sterling edges higher 0.76% to $1.2313 after the BoE Governor Andrew Bailey signaled that interest rate decisions would focus on fighting inflation. And he said that it would not be swayed unduly by worries about the health of the global banking system. Furthermore, he added that banks in the UK were resilient and able to support the economy. Therefore, pound traders have priced in one more rate hike from the BoE this year, driving up the pound value. In addition, investors can keep an eye on the upcoming UK GDP data, which will be released on Friday, for further trading signals.

The pound is crossing the resistance level of 1.2298 and now trading at 1.2313 as of writing. Traders should monitor whether the pound can stand firm above the level. If it can stand firm above the resistance level, we could expect the trend to continue moving upward. MACD has illustrated bullish momentum ahead. RSI is at 61, indicating the pound is trading in a bullish momentum in the short term.

Resistance level: 1.2425, 1.2613

Support level: 1.2298, 1.2190

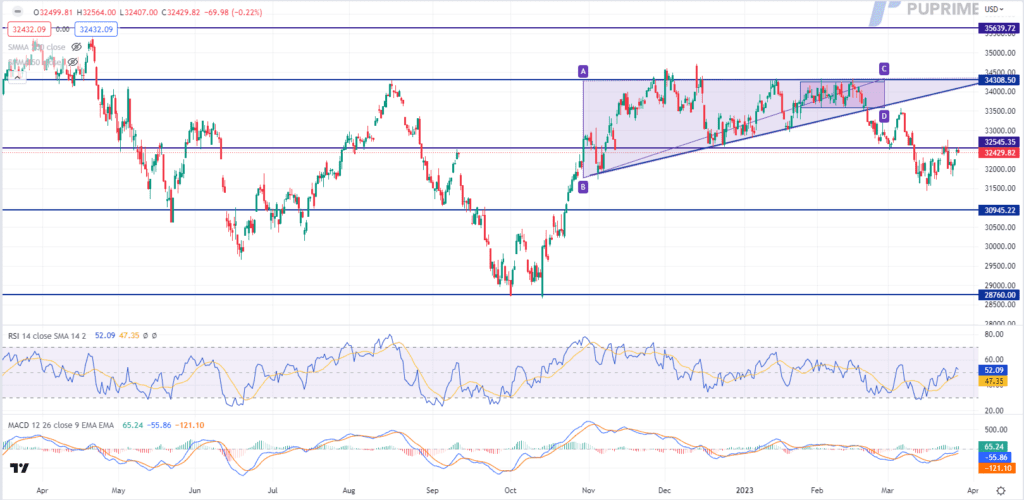

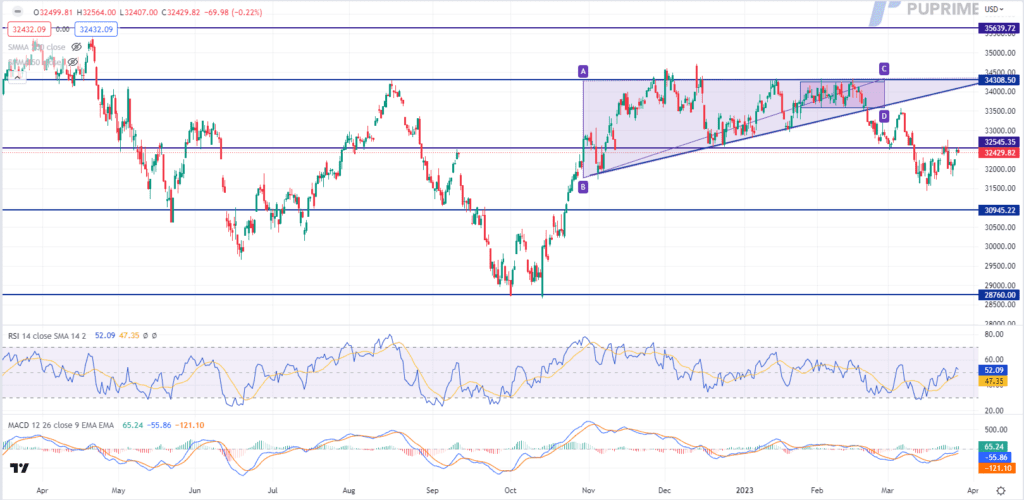

The Dow surged on accelerating risk appetite in the global financial market, buoyed by news of First Citizens Bancshares’ acquisition of the remaining assets, loans, and deposits of collapsed Silicon Valley Bank for a staggering $72 billion. The move has brought some much-needed relief to investors who have been grappling with a wave of banking turmoil in recent weeks and sparked a surge in First Citizens Bancshares’ share price, which skyrocketed by over 53% on the news. With the banking turmoil now seemingly under control, market participants are turning their attention back to the monetary policy decisions of global central banks.

The Dow is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 52, suggesting the index might extend its gains after breakout.

Resistance level: 32545.00, 34310.00

Support level: 30945.00, 28760.00

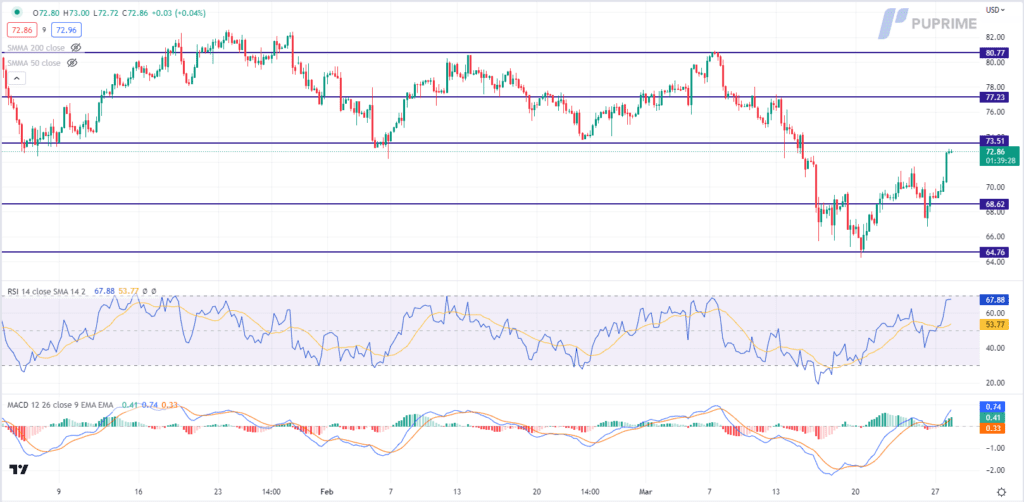

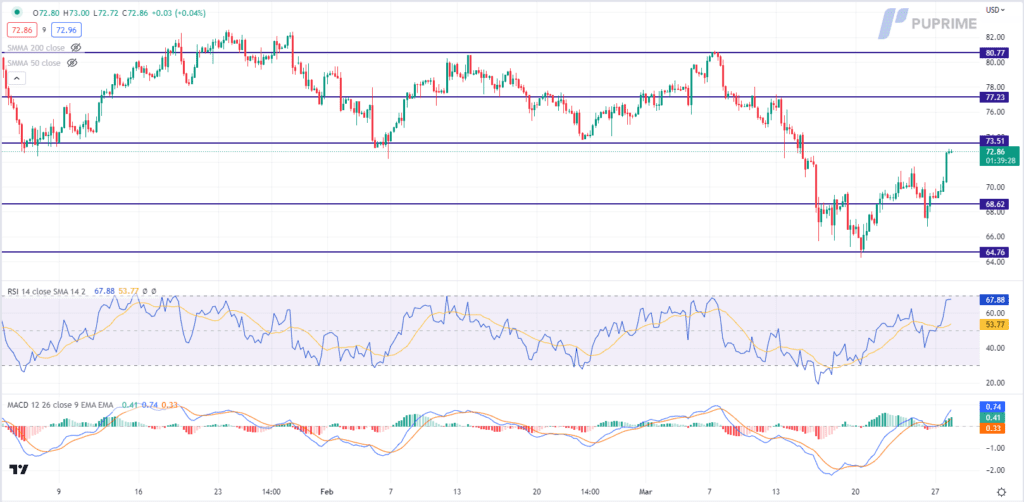

Oil prices surged on Monday as market participants reacted to a series of geopolitical events that have raised concerns about supply disruption. Firstly, Iraq has halted crude exports from the semi-autonomous Kurdistan region and northern Kirkuk fields after winning a longstanding arbitration case against Turkey. This decision is expected to affect about 450,000 barrels per day (bpd) of crude, which represents around half a percent of global oil supply. Furthermore, President Putin’s plan to station tactical nuclear weapons in Belarus to provide a warning to NATO over its military support for Ukraine has intensified geopolitical tensions and added to concerns of oil supply disruption.

Oil prices are trading higher while currently near the resistance level. MACD has illustrated increasing bullish momentum while RSI is at 68, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 73.50, 77.25

Support level: 68.60, 64.75

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

8 August 2023, 06:21 U.S. Equity Market Closes Higher Ahead of CPI

7 August 2023, 06:10 Dollar Softer After NFP Comes Short

4 August 2023, 06:20 BoE Delivers 25 BPS Rate Hikes Softening Pound Sterling

Registrazioni Nuove Non Disponibili

Al momento non stiamo accettando nuove registrazioni.

Mentre le nuove registrazioni non sono disponibili, gli utenti esistenti possono continuare le loro sfide e attività di trading come al solito.