Unisciti alla Sfida di PU Xtrader Oggi

Fai trading con capitale simulato e guadagna profitti reali dopo aver superato la nostra valutazione del trader.

Unisciti alla Sfida di PU Xtrader Oggi

Fai trading con capitale simulato e guadagna profitti reali dopo aver superato la nostra valutazione del trader.

30 June 2023,05:44

Daily Market Analysis

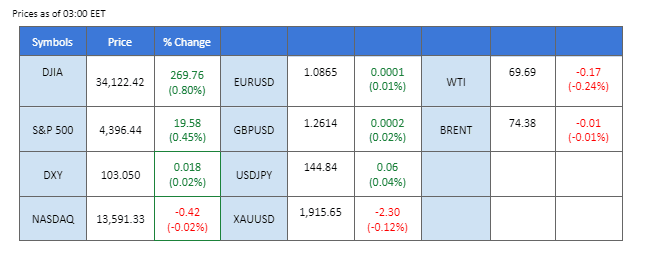

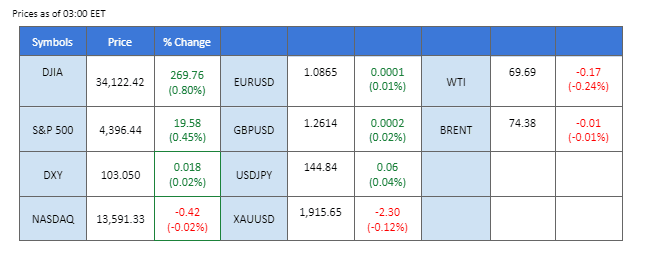

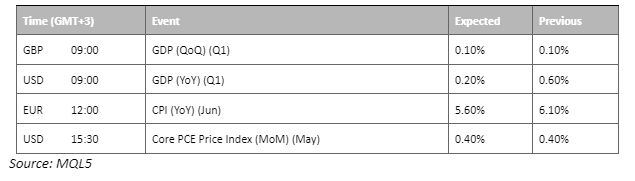

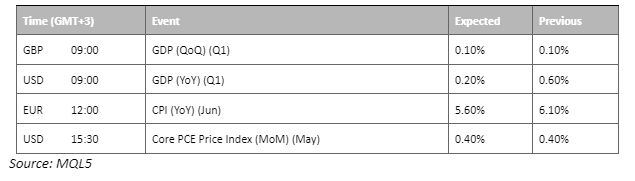

The US Dollar has gained strength as economic data surpassed expectations. Meanwhile, the robust banking sector sparked bullish momentum in the US equity market. The Federal Reserve’s stress test results showcased the resilience of major banks, including Wells Fargo, JPMorgan Chase, and Goldman Sachs. Additionally, positive indicators in the form of solid GDP growth and a declining number of Americans filing for unemployment benefits further highlighted the vitality of the US economy. Crude oil prices surged after a substantial weekly drawdown in US crude stocks, reflecting encouraging demand. Japanese yen dipped as downbeat inflation data from Japan reinforced the Bank of Japan’s expectations to maintain its quantitative easing program. Investors are advised to closely focus on the forthcoming PCE Index figures, which will provide crucial trading signals.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (11%) VS 25 bps (89%)

The US Dollar continues to exhibit bullish momentum, supported by a series of encouraging economic data. Notably, the US GDP for the recent period came in at a solid 2.0%, surpassing market expectations of 1.40%. This robust growth figure demonstrates the resilience and vitality of the US economy. Another positive indicator for the US economy lies in the declining number of Americans filing new claims for unemployment benefits. Last week witnessed the most substantial drop in initial jobless claims in 20 months, highlighting the economy’s resilience. The figure decreased from the previous reading of 265,000 to 239,000, surpassing market expectations of 266,000.

The dollar index is trading higher while currently testing the resistance level at 103.35. MACD has illustrated increasing bullish momentum, while RSI is at 65, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 103.35, 103.90

Support level: 102.75, 102.00

The gold market experienced a notable slump as it grappled with the influence of upbeat economic data emanating from the United States. This development, accompanied by a sparkling bullish momentum surrounding the US Dollar, exerted downward pressure on dollar-denominated gold. However, with the impending release of the PCE Index data, the overall trajectory for gold remains shrouded in uncertainty. Consequently, investors are urged to diligently focus on the forthcoming PCE Index figures, which will serve as a critical barometer for assessing the potential movements within the gold market.

Gold prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 43, suggesting the commodity might be traded higher as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1930.00, 1950.00

Support level: 1900.00, 1865.00

EUR/USD experienced a slight retreat amid the strengthening US Dollar, primarily due to the lack of market catalysts from the EU region. However, the Euro’s losses were limited by high inflation data, with German consumer prices surpassing market expectations, rising by 6.80% on a yearly basis in June. This robust inflation data from Germany, the largest economy in the eurozone, strengthens the possibility of the European Central Bank (ECB) tightening its monetary cycle in the future.

EUR/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 37, suggesting the pair might extend its losses after breakout since the RSI stays below the midline

Resistance level: 1.0920, 1.0995

Support level: 1.0840, 1.0765

Despite a rebound from fresh weekly lows, the long-term trend for the AUD/USD pair remains pessimistic due to the continued strength of the US Dollar. Market focus now shifts to the upcoming interest rate decisions by the Reserve Bank of Australia (RBA) next Tuesday. While markets anticipate a dovish stance and no change in the cash rate, the tight labour market and elevated inflation leave room for potential policy adjustments, introducing an element of uncertainty for the pair.

AUD/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 39, suggesting the pair might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 0.6625, 0.6675

Support level: 0.6555, 0.6465

The Japanese Yen continued to slump following the release of downbeat inflation data, as Japan’s Tokyo Core Consumer Price Index (CPI) fell short of market expectations at 3.2% year-on-year. The disappointing inflation report reinforced the belief that the Bank of Japan will maintain its quantitative easing program, widening the yield spread between Japan and other hawkish major central banks like the Federal Reserve and the ECB.

USD/JPY is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 76, suggesting the pair might enter overbought territory.

Resistance level: 145.35, 150.15

Support level: 141.60, 138.95

The bearish momentum in the GBP/USD pair can be attributed to the strength of the US Dollar, as the UK region lacks significant market catalysts. The recent positive economic data from the United States has surpassed expectations, leading investors to reevaluate the likelihood of a more aggressive rate hike from the US.

GBP/USD is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 34, suggesting the pair might enter oversold territory.

Resistance level: 1.2695, 1.2830

Support level: 1.2545, 1.2355

The Federal Reserve’s stress test results have bolstered confidence in the US banking industry, propelling the Dow to surge. Wells Fargo & Company, JPMorgan Chase & Co, and Goldman Sachs Group Inc led the rally, highlighting the strength of major banks. This optimistic outlook stems from the stress test’s findings, indicating that 23 of the largest US lenders possess the resilience to withstand even a severe recession scenario.

The Dow is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 58, suggesting the index might extend its gains after breakout the resistance level since the RSI stays above the midline.

Resistance level: 34210.00, 34835.00

Support level: 33685.00, 33155.00

Crude oil prices extended their upward trajectory for a second consecutive day, propelled by investors digesting a substantial weekly decline in US crude stocks. This drawdown served as a positive signal, reflecting an encouraging demand for the coveted black commodity. While the recent rate hike decisions by global central banks have introduced an element of uncertainty, the resilient nature of economic growth persists. Consequently, investors find themselves grappling with a dilemma: whether to prioritise the prospects of robust economic expansion or the implications of a tightening monetary cycle when considering entry into the oil market

Oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum. On the other hand, RSI is at 54, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 70.70, 74.20

Support level: 67.20, 65.00

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

8 August 2023, 06:21 U.S. Equity Market Closes Higher Ahead of CPI

7 August 2023, 06:10 Dollar Softer After NFP Comes Short

4 August 2023, 06:20 BoE Delivers 25 BPS Rate Hikes Softening Pound Sterling

Registrazioni Nuove Non Disponibili

Al momento non stiamo accettando nuove registrazioni.

Mentre le nuove registrazioni non sono disponibili, gli utenti esistenti possono continuare le loro sfide e attività di trading come al solito.