Unisciti alla Sfida di PU Xtrader Oggi

Fai trading con capitale simulato e guadagna profitti reali dopo aver superato la nostra valutazione del trader.

Unisciti alla Sfida di PU Xtrader Oggi

Fai trading con capitale simulato e guadagna profitti reali dopo aver superato la nostra valutazione del trader.

20 June 2023,05:42

Daily Market Analysis

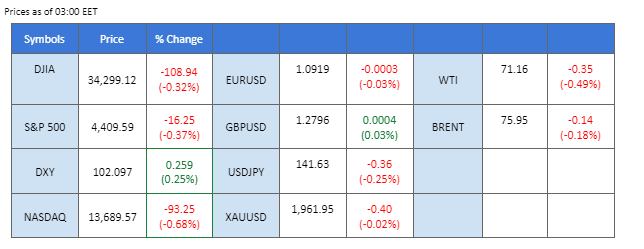

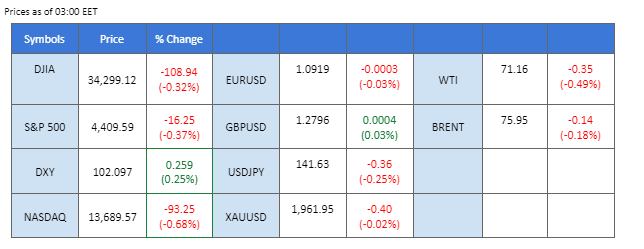

Last night, the U.S. Secretary of State met with the Chinese President and expressed satisfaction with the accomplishments of their trip. This positive development in bilateral relations has the potential to bolster both countries’ equity markets. In contrast, the Governor of the Reserve Bank of Australia (RBA) has emphasised the need to raise interest rates due to encouraging economic indicators, including the labour market and housing prices. According to Goldman Sachs, the RBA’s rate is expected to reach 4.85% from its current level of 4.1%, which could strengthen the Australian dollar. Additionally, China has announced its first reduction in the benchmark lending rate in 10 months, a move that could provide support for oil prices.

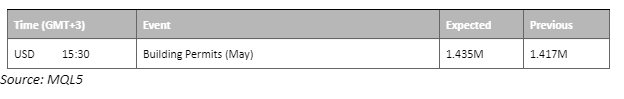

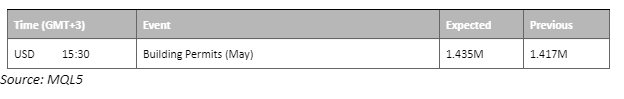

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (26%) VS 25 bps (74%)

The US Dollar experienced a marginal uptick in trading activity, albeit in thin volumes due to the influence of holiday-induced market conditions. Investors engaged in a comprehensive assessment of the ramifications of the previous week’s central bank determinations, which kept the overall movement of the US Dollar relatively constrained. With the US markets shuttered in observance of the Juneteenth holiday, market participants should closely monitor forthcoming economic data from the United States to identify potential trading signals.

The dollar index is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 43, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 102.75, 103.35

Support level: 102.00, 100.80

Gold prices sustained their position within a critical channel, showing a slight retracement from the resistance level. The lack of significant market catalysts specific to the gold market on the preceding day prompted investors to engage in profit-taking activities.

Gold prices are trading lower following the prior retracement from its resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 48, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 1965.00, 2000.00

Support level: 1940.00, 1900.00

The Euro has a slight decline after a bullish run last Thursday. The dollar gained after the U.S. Secretary of State claimed the progression for his trip to China is positive. He also met with the Chinese President last night to signal that the relationship between the 2 nations is improving. Besides, Jerome Powell will deliver his semi-annual monetary report to the Senate on Wednesday ( 21st June); his comment at the House may also impact the dollar.

EUR/USD slightly declined after it gained nearly 2% last week. The pair is currently held above the Fibonacci retracement level of 23.6% at 1.091. if the Euro is able to rebound from the level will show a bullish signal for the pair. Both the RSI and the MACD have given a neutral signal for the pair at the moment.

Resistance level: 1.0947, 1.0981

Support level: 1.0891, 1.0842

The Australian Dollar faced a notable downturn as the minutes from the Reserve Bank of Australia’s meeting were released, revealing a shift towards a more dovish stance. Investors swiftly adjusted their expectations, scaling back their anticipation of the timing and extent of future interest rate hikes. The minutes highlighted the board’s acknowledgment of significant uncertainty surrounding household spending and the financial pressures confronting some households. The Reserve Bank of Australia described its decision to raise the official interest rate in June as a finely balanced one, emphasising that future increases would depend on the impact of domestic and international developments on the inflation outlook.

AUD/USD is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 61, suggesting the pair might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 0.6830, 0.7025

Support level: 0.6585, 0.6415

Pound Sterling maintained its upward trajectory, nearing a remarkable 14-month pinnacle against major currencies. The currency’s bullish sentiment was fueled by the mounting optimism of investors, who embraced the hawkish stance projected by the Bank of England in the wake of recent monetary decisions made by prominent central banks. This divergence in policies between the Bank of England and the Federal Reserve further widened the yield-spread between the US and the UK, intensifying the appeal of the Pound Sterling among global investors.

GBP/USD is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 68, suggesting the pair might enter overbought territory.

Resistance level: 1.3060, 1.3710

Support level: 1.2550, 1.2190

The Hang Seng index has a technical retracement after it surged drastically since the start of June. The effort from the U.S. to fine-tune the relationship between China and the U.S. and send their top diplomat to China sees a favourable implication for the equity market. Besides, HKEX has launched the HKD-RMB dual counter model, allowing investors to trade Hong Kong listed counters with Chinese RMB. The move is expected to have a positive impact on the Hang Seng Index.

The HK50 experienced a technical retracement after it broke above its psychological resistance level at 20,000. The RSI has declined from the overbought zone while the MACD is moving toward the zero line from above suggesting a trend reversal for the index.

Resistance level: 20015.00, 20570.00

Support level: 19280.00, 18840.00

Oil prices plummeted as Goldman Sachs joined other major banks in revising down China’s economic growth expectations. The investment bank lowered its full-year GDP growth forecast for the world’s second-largest economy from 6% to 5.4%, citing concerns over the property market downturn. The pessimistic outlook contributes to diminishing demand from China, the largest crude importer globally. Amidst the complexity of ongoing impact from the monetary policy decisions from several major central banks, the global economic outlook remains uncertain. Investors must exercise caution, continually monitoring economic conditions for potential trading signals

Oil prices are lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 57, suggesting the commodity might trade lower as technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 72.00, 74.20

Support level: 68.90, 61.90

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

8 August 2023, 06:21 U.S. Equity Market Closes Higher Ahead of CPI

7 August 2023, 06:10 Dollar Softer After NFP Comes Short

4 August 2023, 06:20 BoE Delivers 25 BPS Rate Hikes Softening Pound Sterling

Registrazioni Nuove Non Disponibili

Al momento non stiamo accettando nuove registrazioni.

Mentre le nuove registrazioni non sono disponibili, gli utenti esistenti possono continuare le loro sfide e attività di trading come al solito.